ENQUIRE NOW

ENQUIRE NOW

NEW EQUIPMENT

Home | You searched for “no alcohol”

Low/no alcohol: Low2NoBev showcases vibrant drinks sector!

It’s great to be back in person at a live event! The past 18 months have seen few face-to-face trade events. However, this hasn’t stopped the drinks category from innovating, particularly within the low/no category.

Low and no category surges

Consumer demand for low and no alcohol drinks continues to rise. Kantar reports that, for the 52 weeks to 21st February 2021, retail sales have increased by over 50% to £217m.

Stocking a good selection of low and no alcohol drinks has assumed ever-increasing importance now for both on and off-trade. This is further highlighted by a recent YouGov/Portman Group online survey of 2,100 UK adults. The research showed that around two-thirds of UK adults had tried a low and no product (under 1.2% ABV). Additionally, a quarter of current alcohol drinkers are ‘semi-regular consumers’ (often or sometimes choosing low/no drinks).

Low2NoBev Trade Fair

Greater acceptance of the advantages of responsible drinking and its effects on health and wellbeing are driving this trend. So with more venues reopening, it’s a great time to support this burgeoning drinks sector.

Low2NoBev is the only dedicated show for this category. Producers showcased their range of low/no drinks at The Old Truman Brewery in East London on 9th and 10th June. Here are a few highlights.

Low/no craft beer

The low/no craft beer industry is still relatively young. Some companies are already well-established like the superb Big Drop Brewing Co.. Check out their brilliant new Tailwind IPA! There’s also Nirvana Brewery, which only launched in 2017 but has quickly built up a loyal group of followers.

Lucky Saint

Lucky Saint alcohol-free lager is another well-known name. Last year before COVID struck, the beer was the first independent alcohol-free lager to be served on draught. You can read more about this here on Ryebeck’s Industry Insight pages. With lockdown lifting, the signs are very positive that the company will continue to grow.

Freestar

Many craft beer companies place ethical and environmental considerations at the heart of their operations. So, it was great to catch up again with the guys from B Corp-certified Freestar. Their innovative, eco-friendly beer is made, not by brewing, but by blending all-natural ingredients. These include hops, malted barley and water, without adding any yeast. Is it a beer? Well, the judges at the prestigious World Beer Awards thought so. It’s a 2019 Premium Alcohol Free Beer category winner! So there’s the answer!

Unltd.

Unltd. is another new brand that stood out at the trade show. Launching in June 2020, the timing during lockdown was a challenge. However, it hasn’t stopped the beer winning two European Beer Challenge Golds, as well as Gold Medals for the bottle design at the World Beer Awards! There are two beers – a lager and an IPA – both low calories, gluten-free, vegan-friendly and only 0.5% ABV.

Founder Johnny Johnson chose the ingredients for their nutritional values. “We wanted our beer to have enough vitamins B6 & B12 to be able to state it on our labels, to further promote the healthy benefits to our AF beer.”

The name came from the feeling Johnny had when he took a break from alcohol. “I felt truly unlimited“, he says. “I was more productive and exercising more. The potential I felt was limitless, so that’s where UNLTD. came from.”

Days Brewing

Edinburgh’s Days Brewing launched their 0% ABV craft lager and pale ale in September last year. The company is committed to using the finest local ingredients in their beers. These include water from southern Scotland’s Lammermuir Hills and premium malt from locally-grown barley. The beers have quickly won many fans, including Tom Kitchin, who now stocks them in his Michelin-starred restaurant, The Kitchin.

The company supports charitable initiatives, including Run for Heroes and they donate 2% of sales towards mental health causes.

Hepworth Brewery

Award-winning Hepworth Brewery began production in 2001. Several of their beers are gluten-free and their latest brew is a unique 0.5% ABV organic lager. Aztec is made initially with a blend of Czech and German hops and malts. The result is then blended with the syrup and dietary fibre (inulin) of the agave cactus. This produces a distinctively refreshing beer with body and flavour.

Athletic Brewing Company and Loah Beer are two further companies producing delicious, alcohol-free beers. Future articles will provide more information on these innovative companies’ products.

Alternative lower alcohol beer choices

While there many products at 0.5% ABV or lower, one feature of the show was the emergence of craft brands trying to find their own, alternative lower alcohol space.

Small Beer

Small Beer, which you can read about here on Ryebeck’s Industry Insight pages, is already an established brand. Uniquely producing ‘small beer’ of up to 2.8% ABV, they have now produced a 2.3% organic IPA. It’s deliciously fresh and fruity with a subtle biscuity edge, reminiscent of the traditional British IPA style but with much lower alcohol.

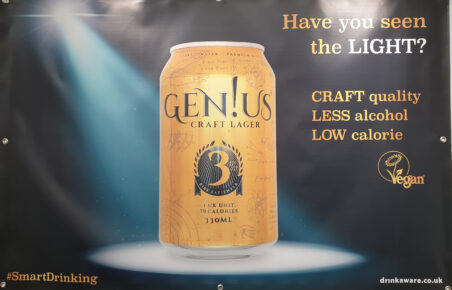

Gen!us Beer

Gen!us Brewing launched their ‘light beer’ in 2018. Founders Jason Clarke and Charlie Craig see this version of #SmartDrinking as an important new category in the UK. At 3% ABV, Gen!us is a craft lager, similar to the light, refreshing craft beers prevalent in the USA. It’s low in calories, but not low in flavour. You can find their cans at selected retailers listed on their website. Could ‘light beer’ like this be a new category in the UK? Something to look out for certainly.

Other low, no and lower alcohol drinks

In addition to beer, other categories such as non-alcoholic wine and spirits were also represented at the show. Highlights of these include Bottega 0 Rosé, a non-alcoholic sparkling rosé wine and Vallformosa 0.0, a sparkling zero alcohol Cava.

Caleño

Caleño is an award-winning brand of distilled non-alcoholic tropical spirits, imbued with Latin American soul! Founder Ellie Webb has Colombian roots and so wanted to create a fun alcohol-free drink with the sun-drenched flavours of her family’s country.

Light & Zesty is a light and zesty blend of tropical, citrus and spice botanicals, including golden Inca berries. For a simple mocktail, pour 50ml over ice, top with tonic and garnish with a tropical Inca berry. Dark & Spicy is a rich, warming infusion packed with dark pineapple tropical notes, ginger & kola nut spices. Ellie recommends serving this with tonic and a squeeze of fresh lime. Other non-alcoholic cocktail recommendations are listed on their website.

Feragaia

Heading closer to home for inspiration, Feragaia is a distilled alcohol-free spirit from Scotland. Fourteen natural land and sea botanicals are distilled in a pot still, before being cut with Scottish water. The result is a fabulous and unique expression of the ‘Spirit of Wild Earth’ with real depth of flavour. Check out their website for some fantastic cocktail recipes.

MARY

Award-winning MARY is a botanical blend made with responsibly sourced garden herbs. At only 6% ABV and a mere 9 calories per single pour of 25ml, this is another innovative drink that offers consumers a real alternative to a full-alcohol spirit. It’s fresh, dry, refined and versatile in a number of cocktails. For example, a MARY & Tonic has only 2% ABV and is packed full of fresh herbal flavours. MARY hits the sweet spot between the sophisticated taste that only alcohol can deliver and consumers’ desire to moderate their alcohol consumption.

Alcohol-free functional drinks

Low/no alcohol is not just about taking ingredients and processes out. It can also be about adding other elements in. Whether that’s CBD, vitamins, minerals or anything else, this is one new development that’s sure to grow.

Fungtn

Fungtn, made by the Fungtional Brew Company, is the first alcohol-free beer range brewed with adaptogenic functional mushrooms. These mushrooms contain certain compounds that are said to help the body maintain natural homeostasis. What does this mean? It’s the body’s ability to perform at its best, including the ability to cope with stress. The use of adaptogens is based on ancient healing traditions and the Fungtn beers are all made with different mushrooms. These are rich in polysaccharides and so add mouthfeel to the beer, rather than giving a mushroom flavour! For example, Lion’s Mane IPA delivers stone fruit notes and a delicate bitterness.

Sentia

Sentia is an ‘active botanical spirit’ designed to mimic the kick of alcohol, but without the negative effects. Created with the scientific input of leading neuropsychopharmacologist, Professor David Nutt of GABA Labs, this is another world first. Professor Nutt and his team have developed ‘Alcarelle’, a proprietary mix of plant-derived functional compounds and nutrients. These work on the body’s GABA system which regulates normal social interactions in a similar way to alcohol. Both produce relaxing, sedative effects and Sentia is alcohol-free. While there is more work to be done in this area, the results are very promising and the drink is delicious too!

Author: Robin Goldsmith of The Write Taste.

Low and No Alcohol: a growing category that cannot be ignored!

Before COVID-19 struck, there had already been an explosion of new drinks on the market with little or no alcohol. Whether non-alcoholic soft drinks with sophisticated flavours, mocktails or other alternatives to traditional spirits, there is a huge amount of innovation in this category. Quality has also improved, spurred on by a sense of adventure, experimentation, wellness and lifestyle changes. Producers are keen to take their position at the premium end of the sector. Consumers are no longer faced with a lack of decent options.

Coronavirus has changed our lives and our drinking habits. It’s also had far-reaching effects on the hospitality industry. See Ryebeck’s recent article on The Impact of Lockdown on Beer Enthusiasts for more information. So when we are over this pandemic ?, what can we expect to see from the world of ‘low and no’? Let’s imagine a world where we can all go down the pub again and enjoy a drink with a crowd of friends …

Hotel, Restaurant and Catering Show (HRC)

Earlier this year, at the Hotel, Restaurant and Catering Show (HRC), Blake Gladman, Strategy and Insight Director of research consultancy KAM Media, gave a talk on the rise of the ‘Low and No’ alcohol category. With more people drinking at home as a result of COVID, this category has assumed increased importance, both commercially and in the health of the nation.

KAM Media Research

Last December, KAM Media spoke to 1000 consumers about their behaviours around these drinks. Questions tackled assumptions and perceptions about the category, where people buy from, awareness of ranges and barriers to purchasing. At the HRC, Blake presented highlights from KAM Media’s extensive research.

Consumption behaviours around ‘low and no’

One in five consumers in the UK are teetotal, rising to two in five among 18-24-year-olds. This latter group represents “the generation Z who are much more aware of moderation and so more likely to abstain from alcohol“, said Blake. “It will be interesting to see how this movement looks in 10 years’ time“, he added. “Once those 18-24-year-olds become the 35-year-olds and we see that new generation coming through, will we see the same or increases in those behaviours?”

Reducing alcohol consumption

Drinking behaviour in the UK is trending towards greater moderation, according to KAM Media. Over one in three people have attempted ‘Dry January’ or said they would be attempting ‘Go Sober’ October in 2020. The research showed that 62% of UK adults claimed to consume a maximum of five units of alcohol on average each week. Also 40% of alcohol drinkers said that they would be reducing their consumption in 2020, 47% of those for health reasons.

However, Blake was keen to stress that these are ‘claims’. “There’s an element of people underestimating how much they consume or knowing that they consume too much. They may be deliberately under-egging the amount of alcohol“, he noted. “Perhaps at a subconscious level, there’s a recognition that people need to reduce their consumption or would like to be able to do this.”

KAM Media’s figures show that 329 million adult pub visits in 2019 did not include an alcoholic drink. Lockdown and other social restrictions have resulted in more people drinking at home. Only time will tell whether this will lead to a long-term increase in alcohol consumption. However, as Ryebeck’s earlier report mentioned, beer enthusiasts drank lower quantities overall. So, there’s nothing to support any notion that we Brits just boozed our way through lockdown and further social restrictions.

Reasons for consuming less alcohol

Crucial to understanding these findings is determining consumer motivations for greater moderation of alcohol. These fit into several categories, of which the top two are ‘general health concerns’ and ‘saving money’. However, for those looking to switch to low/no products, spending less isn’t always the case – see later in this review. Other reasons include losing weight and the desire not to lose out on opportunities to do alternative activities.

Flexible drinking

Blake sees much in common between the rise of the low/no category and that of veganism/vegetarianism. “We now see these meals front and centre on menus, not hidden away at the back. It’s the same for ‘low and no’. The category shouldn’t be an afterthought at the back of a menu! With social changes, it’s now come more to the forefront. People are switching to eating less meat or switching to drinking less alcohol. However, a larger proportion of people are looking to flex how they do it. We see the rise in ‘flexitarianism’ and perhaps something similar in alcohol. There’s a similar mindset in terms of moderation if people are looking to flex when and where they drink alcohol. Other times, they automatically would have thought about having an alcoholic drink. Now there are greater options and potentially, they can make a better choice.”

So, it’s not just about switching off alcohol completely. It’s about alternating between drinking ‘low and no’ and alcoholic drinks as a way to reduce alcohol consumption on a night out. Approximately, one in six consumers are looking to mix between the two categories, including 22% of 18-34-year-olds.

Maintain customer experience

The challenge for the industry is to ensure that when the consumer chooses a low/no or traditional alcoholic drink, they receive exactly the same the experience and customer service. For Blake, this is key, “whether it’s in the taste profile of the drink, how it’s served or everything else that comes with it.”

Brewdog took this concept one step further by opening the world’s first alcohol-free bar in London. They have over ten beers on draught of 0.5% ABV or under plus bottles and cans. Importantly, the experience and atmosphere resemble a regular Brewdog bar. “It’s everything you’d expect from a pub experience“, described Blake. “People who drink low or no alcohol beer want to go to a pub and not have a different experience“, he added.

Consumer awareness

Among two-thirds of consumers polled, there is more awareness about ‘low and no’ options within beer than other drinks. In contrast, less than one in two were aware of the choices in either wine or cocktails. So, the onus is on operators to drive that awareness, believes Blake. This can be via menus, through advertising or displayed in more prominent positions in retail environments and pubs.

Encouragingly, newspaper supplements have begun to include recommendations on a more regular basis. Also, supermarket ranges are growing, sometimes with whole aisles dedicated to ‘low and no’ options. However in pubs, only one in four people have noticed ‘low and no’ brands. Often, these drinks are hidden at the bottom of a packed fridge. As a result, the customer may only find one if they specifically ask for it. More awareness and product visibility would surely see an increase in sales of these products. This is particularly relevant at the premium end of the category.

Pubs and restaurants

The pandemic has skewed our opportunities to visit pubs and restaurants. However, the findings from KAM Media’s research remain very relevant today. Roughly one in four pub visits and one in three restaurant visits are non-alcoholic. Together with the statistics showing that one in five people are teetotal, this shows that consumers are flexing their approach much more. Many of these visits, Blake explained, could be work-related or simply a lifestyle choice at the time. This highlights the size of the market and the potential opportunities to increase consumer spend on more premium ‘low and no’ alcoholic brands rather than the traditional better-known ones.

How to drive consumer choice when away from home?

KAM Media’s research show that 45% people would look at the menu when deciding on a non-alcoholic drink. Around one in three will have their usual drink. Approximately one in five will look behind the bar and a further one in five will ask staff. So, it is clear that hiding choices on a menu or at the bottom of a fridge limits opportunities to consumers.

Alcohol-free lager in a pub garden

There is also a big opportunity to increase the knowledge of staff. They can then offer alternative choices to the usual soft drinks, talk about flavour profiles and inspire consumers to try something new.

Barriers and perceptions around the ‘low and no’ category

Perhaps the biggest challenge to the industry is overcoming consumer pre-conceptions. Out of all the reasons identified, 33% of people believe that the drinks don’t taste the same as their alcoholic equivalents. Therefore, they would rather have something different, probably a regular soft drink. Almost one in five people wouldn’t switch to the category, because they like the taste of alcohol.

Prices of ‘low and no’ drinks

However, one of the most important factors affecting consumer uptake of these drinks concerns the pricing. There’s a perception that alcohol content is a significant driver towards the cost of a drink. Two in three people polled expect low and non-alcoholic drinks to be less expensive than their alcoholic equivalents. On average, customers expect ‘low and no’ drinks to be 20% cheaper, but one in five expect them to be more than 25% cheaper.

Are customers prepared to pay more if the product is right?

Over one in five customers would be prepared to pay more for a low/no version of their favourite alcoholic drink. In contrast, over one in three people would be willing to pay more for an ‘adult’ soft drink like Kombucha, compared to traditional options such as lemonade.

Currently, there are greater opportunities for premium soft drinks brands. The use of natural ingredients and premium packaging make them look as if they should be more expensive. So, how can the ‘low and no’ category win over new consumers, given the perception that alcohol is the main driver dictating the price of these products? Perhaps lessons can be learned from Brewdog. At their new AF bar, the price of their beers is what you’d expect to pay for a regular beer at a pub. This highlights further the benefit of making customer experience the same, whether it’s an alcoholic or a no-alcohol drink being served.

Experience of publicans

KAM Media spoke to 200 publicans about their views on the category. One in two have seen an increase in purchases. As a result, 66% increased their range in 2019 and a further 48% said they would be increasing their range in 2020. However, while 57% of publicans want to sell more ‘low and no’, 69% of them would like to see increased support from brands. Also, 61% would like to see more support from their pub company. Therefore, publicans are looking for inspiration and knowledge on which products they should be selling, how these should be served and how best to charge a premium price.

The hospitality industry has suffered particularly badly during the COVID-19 crisis and continues to do so. However, this research shows that the ‘low and no’ category does have a positive impact for the sector. Pubs, who have historically been built on alcoholic offerings, see diversification of that range as a crucial element for keeping the industry alive. As Blake said: “Hospitality is built on atmosphere and diversification, not just on alcohol. The pub is, above all else, a social space.” Let’s all hope it can continue to be so.

Final thoughts

The ‘low and no’ movement is still relatively young. Despite the coronavirus pandemic, the future does look promising with new products and companies dedicated to producing new premium brands. Indeed, since the original analysis, KAM Media describes continuing growth in the low and no alcohol category. Sales are reported to be up 30% in the off trade (Nielsen) and up by nearly 50% in the on trade (CGA).

Perhaps COVID really has encouraged many drinkers to become more health conscious, cutting down on sugar and alcohol in particular. A new generation of more discerning drinkers, particularly among 18-24 year olds is looking for quality, flavour and lower alcohol. On-trade venues have already been adapting with a better range of options. Bartenders look set to embrace ‘low and no’ cocktails as a core part of their offerings. Similarly, consumers drinking at home want a better choice of options with easy availability for purchases. These can be online, at supermarkets and specialist stores or direct from the producer.

In this new world, perhaps one thing is certain. We should all be able to look forward to a better choice of drinks wherever and whenever we can safely go.

For more articles on the latest drinks trends, including the ‘low and no’ category, visit Ryebeck’s Industry Insight pages.

Author: Robin Goldsmith of The Write Taste.

Penrhos Zero alcohol-free botanical spirit

Alcohol-free is all the rage now, isn’t it? Full strength beers, wines and spirits remain ever popular. Yet the choice and quality of AF options are improving all the time.

Lockdown effects

Despite an increase in at-home drinking, the closure of on-trade venues during lockdown has seen a decline in alcohol consumption. Also, without being able to go out or socialise as before, many people’s minds have refocussed on healthier living choices. This includes choosing low or no alcohol options, as well as reducing alcohol intake in general.

Reducing alcohol consumption

Kam Media‘s analysis from last year showed that one in five adults polled in 2019 claimed to be teetotal. More recent research found that 32% of UK adults plan to reduce their alcohol consumption this year. Also, nearly 50% of consumers have now tried a low or no alcohol variant.

Alcohol-free spirits

According to IWSR data from 2017 to 2019, UK volume sales of non-alcoholic spirits grew by 170%. This is a category that didn’t really exist until a few years ago!

The trend for moderation and wellness started well before lockdown. Today it continues to resonate very strongly with consumers. There are many choices now for mocktails and home creation of G&Ts, without the alcohol but with flavour. One exciting new addition to the category is Penrhos Zero Raspberry, a non-alcoholic botanical spirit made with farm-grown fruit.

Penrhos

Penrhos Spirits is based in the agricultural haven of the Herefordshire Marches. Their story began in 2017 when fruit farmers, Richard Williams and Charlie Turner, decided to create a gin distillery. They particularly wanted to utilise as much of the produce on their farm as possible. Through Ryebeck, they were able to source a 150L Carl still, perfect for their needs. They named it Connie after Richard’s grandmother who’d worked in the original cow shed converted to today’s distillery. You can read the story of how Ryebeck helped Richard and Charlie on their journey from farmers to distillers here.

Penrhos Zero Raspberry

Penrhos Zero Raspberry is their newest product, made with a mix of botanicals. These include juniper, coriander, black peppercorns, farm-grown blueberries and pressed juice from their raspberries. The result is a unique alcohol-free botanical spirit, which contains 15% real fruit juice, rather than purchased fruit extract.

Reducing food waste

Reducing fruit waste with its associated carbon footprint is extremely important to Richard and Charlie. So, Penrhos Zero Raspberry is also a way for them to use the raspberries that aren’t destined for the supermarkets.

Developing the new product

Richard explains the driving force behind the new product and how it was developed. “The non-alcohol market is big, but we didn’t want a run-of-the-mill product. We wanted to keep using all our fruit. I like raspberries, so we worked with another company to create the recipe. It’s quite complex with a new way of distilling.”

How is Penrhos Zero Raspberry made?

The new product is also made on Connie, but with a few adaptations to the column. “We create a steam distillate“, describes Richard. “We boil the water and bypass certain elements of the still to create a flavoured steam. We’ve found a way of recovering it, creating a really strong distillate.”

How to serve Penrhos Zero Raspberry

Serve over ice with tonic and a squeeze of lime. Garnish with frozen strawberries, raspberries or blueberries and a sprig of mint. Penrhos Zero Raspberry costs £24.50 for a 70cl bottle, available from their website shop.

Thanks to Ryebeck

Penrhos London Dry Gin has already won an IWSC Silver and a SIP Awards Gold. The Apple & Elderflower Gin has a Great Taste Award too. The company’s growing success would not be possible without a top quality still, supplied and fitted by Ryebeck. It’s adaptable enough for the Penrhos team to use for different products. “It’s particularly suitable for both the steam distillation and alcohol distillation“, notes Richard. “I thank Ryebeck for their support as ever.”

Author: Robin Goldsmith of The Write Taste.

Alcohol-free lager Lucky Saint launches on draught across UK!

For Not Another Beer Co., 2020 has not been a bad year really. Lucky Saint, their award-winning Superior Unfiltered Lager is winning many new fans and retaining its loyal fan base. Independently and progressively brewed in Bavaria, the beer contains just four natural ingredients – Pilsner Malt, Hallertau Hops, Bavarian spring water and Lucky Saint’s own single-use yeast. The beer is brewed, bottled and packaged in Germany. Therefore, at 0.5% ABV, it can be labelled ‘alcohol-free’ rather than ‘low alcohol’ when sold in the UK. Otherwise the limit is currently 0.05%.

Launch on draught in London

In January of this year, Lucky Saint was the first independent alcohol-free lager to be served on draught. It was launched in 50 venues across London, including Hippo Inns and Electric Star Pubs and sold 30,000 pints in four weeks! During lockdown, the beer became the second-biggest selling alcohol-free lager on Amazon. It is also the first alcohol-free brand to join the British Beer & Pub Association (BBPA).

Lucky Saint lists with Majestic

Then in August, the company announced its biggest off-trade listing to date with Majestic, the UK’s largest specialist wine retailer, launching into all 198 stores nationwide. The partnership came at a significant time with consumer interest in the no and low category booming. In March 2020, the no/low category saw growth of +33% year on year (Nielsen), with one-third of the UK opting to moderate or quit alcohol during lockdown.

Launch on draught nationwide

Lucky Saint has now become the first independent alcohol-free lager to be served on draught throughout the UK. Pub listings include, for example, Brighton’s Lion and Lobster, Bristol’s King Street Brewhouse and other City Pub Co venues.

Luke Boase, Founder of Lucky Saint, gives his thoughts. “Since our successful launch on draught in January, Lucky Saint and the no-and-low category have grown phenomenally. When pubs reopened after lockdown, we wanted to make sure we were meeting consumer demand both on and off-trade. So, rolling out draught listings nationwide was the next step for us, especially with Sober October just around the corner.”

Growth in no-and-low

The launch comes at a significant time for Lucky Saint and the no-and-low category, with 53% of customers saying pubs serving alcohol free draught would make them more appealing places to visit (KAM Media – July 2020).

Meanwhile, general interest in drinking less is at an all-time high. Figures show that 36% of UK adults took part in Dry January 2020 or are interested in trying Sober October. This compares with 10% in 2019 (KAM Media – April 2020).

Lucky Saint itself has seen extensive growth over the last few months, with direct to consumer e-commerce sales increasing 300% over the lockdown period.

You can read more information on how beer drinking habits have changed as a result of lockdown here.

Author: Robin Goldsmith of The Write Taste.

VandeStreek Beer: Going Dutch without the Alcohol!

The availability of no and low alcohol beers is improving all the time. New breweries and new beers from well-established breweries are showing good sales and the category is booming. Amid health concerns and lifestyle choices, many consumers are turning to lower alcohol alternatives, particularly within beer and spirits. Quality is also getting better and shows no sign of plateauing.

Low Alcohol at BrewLDN

While the UK is edging ever closer, Germany and Holland are arguably leading the way in producing flavourful beers of less than 0.5% ABV. One of the best, available in selected UK retailers, is Playground IPA. Made by Dutch brewer VandeStreek, who also brew a varied range of alcoholic options, it has already received much critical acclaim.

Ryebeck spoke to co-founder, Ronald van de Streek, at this year’s inaugural BrewLDN beer festival, which featured many lower alcohol drinks.

Origins of VandeStreek

“I first started brewing with my brother Sander at home, back in 2010, with no ambition to start a brewery whatsoever. Once a month, we were just two brothers coming together to brew a beer and bottle the one we made the previous month as well. Soon we upgraded our system and went from 20L to 50L. Then, after three years, we decided to start brewing commercially. This was all alcoholic, full-strength beer – anything we could think of. So, in 2013 we started making beer commercially as ‘gypsy brewers’ in other people’s breweries. We gained some fame in the Netherlands and we were still doing this alongside our day jobs!”

Non-Alcoholic Beer

Ronald was previously working in marketing for a conference organiser, often within the medical sector. Changing circumstances meant that in 2016, he and his brother decided to work full-time in the business. So, they secured investment to help fund building their brewery. “At the same time, we were also brewing at a German brewery and our girlfriends became pregnant. The brewer was quite familiar with non-alcoholic beers. Because we were missing non-alcoholic IPA, we bought a case of non-alcoholic lager. Then we asked him, why is nobody throwing hops in here!?”

Dry-Hopping

Ronald remembers going through the process of trying to eliminate the various reasons the German brewer gave him for not adding hops. “We wanted to prove him wrong“, he recalls.

“For example, dry-hopping means the beer ferments out a little bit further due to more enzymatic reactions. So this is something we needed to overcome. Otherwise we would have gone over the 0.5% ABV level to call it alcohol-free.”

Changing the Process

As a result, the brothers decided to change their whole process of brewing, as Ronald describes. “We changed the yeast and many other things. In the end, we ended up with a beer that is completely naturally brewed. There’s no dealcoholisation. Nothing is taken out. We’re just adding to the beer and it goes through the same process as all of our alcoholic beers. It will sit in a tank for three or four weeks. We just add more hops, including dry-hopping just like a normal beer, to pack so much flavour in.” … and so Playground Non-Alcoholic IPA was born.

Playground IPA

Ronald sees Playground IPA as unique, because of this extra flavour. “After we launched it in 2016, many other non-alcoholic beers came on to the market, including IPAs. To me, I have not yet found any which is this bitter. We can make this style, because there’s actually quite a lot of residual sugar in it. For me, IPA has to be bitter. Of course, there are some beautiful, hazy New England alcoholic IPAs which really are much like fruit juice. I like them as well. However, Playground is still the only naturally brewed non-alcoholic beer which also has a real bitterness from the hops. The brewery is now making about 5000 hl, of which half is non-alcoholic! We have a team of 15 and we’re still growing really fast. This is mostly thanks to our Playground non-alcoholic IPA.”

The range of vandeStreek beers at BrewLDN

VandeStreek’s Non-Alcoholic Range

VandeStreek brews three beers under 0.5% ABV, which in most of Europe can be classified as ‘alcohol free’. In the UK, the legal limit is 0.05%.

Playground was vandeStreek’s first beer under 0.5% ABV. Since then, they have also created the first non-alcoholic Bock in the world. This is traditionally a high alcohol beer style! Sadly, the beer was not available to sample at BrewLDN. However, Fruit Machine was. It’s a deliciously refreshing raspberry/blueberry sour, which Ronald particularly enjoyed earlier this year. “I did Dry January and this was the beer I kept going back to. It’s only a little bit sour. Drinking IPA all the time and wanting more variation, this was the fruit beer that helped me through the month.”

Playground IPA gains International Recognition

The high quality of VandeStreek Playground Non Alcoholic IPA has been formally recognised within the industry. This mouth-watering, citrus and tropical fruit-laden beer won a Silver Medal at the 2019 Barcelona Beer Challenge. Tasting it at BrewLDN, along with Fruit Machine and their new core beer Hazy Weekend NEIPA, packing a beer with flavour does not appear to present a problem for these innovative brothers!

Playground IPA and Fruit Machine are distributed in the UK by Morgenrot. They are available in selected independent retailers throughout the country. VandeStreek beers can also be purchased online from DryDrinker or LightDrinks.

Other articles featuring beers with lower alcohol levels can be found on Ryebeck’s Industry Insight pages.

Author: Robin Goldsmith of The Write Taste

Hand sanitiser: calls to suspend duty on distillery ethanol

Amid a changing daily landscape of Coronavirus alerts and advice, the alcohol industry is responding. Alan Powell is an excise duty consultant and also co-ordinator of The British Distillers Alliance (BDA). He has recently written to HMRC about the emergency use of distillery alcohol for the ad hoc production and distribution of hand sanitiser.

Excise duty

Although likely to made in small quantities, he notes, the excise duty is over £28 per litre of pure alcohol. This is a huge cost compared to the actual value of the product created. Supermarkets, chemists and home-delivery services are running out of hand sanitiser as soon as it’s available. So, surely now is the time to suspend duty on ethanol converted to hand sanitiser.

Value of hand sanitiser

We all know now that proper hand washing with soap at the right times is one of the best ways to protect ourselves and each other from COVID-19. While soap dissolves the fatty layer that coats the coronavirus, alcohol can kill different types of microbes. These include viruses, by unfolding or denaturing their proteins, breaking the bonds that hold them together.

However, this doesn’t always work. There are many different types of bacteria and viruses. Alcohol sanitisation is more successful against some than others. Many studies have shown that an alcohol concentration of 60% is required to be effective and this is the case with coronavirus.

Is homemade hand sanitiser any good?

The internet is full of recipes for making your own hand sanitiser. Some of these use vodka, which is typically 40% ABV, so ineffective against the coronavirus and may in fact make the situation worse. Health officials working with the United States Environmental Protection Agency have said that “Homemade sanitizers are not formulated specifically to be anti-viral and improper mixing of solutions could lead to spreading sickness.”

So, what about using pure ethanol? Is this even better than using 60% spirit? Apart from causing skin irritation, 100% alcohol evaporates too quickly. It is not as effective at protein denaturation as alcohol mixed with water down to 60% ABV.

HMRC regulations

HM Revenue and Customs (HMRC) regulations state that “Denatured alcohol is alcohol that has been made unsuitable for drinking by the addition of approved denaturants.” In order to produce, stock or distribute it in wholesale quantities, a company must be authorised or licensed. This also applies when excise duty is suspended. However, Powell notes that the duty charge is not remitted unless “the ethanol is statutorily denatured by a licensed denaturer”. Ethanol produced and converted to hand sanitiser by distilleries would, therefore, not be classified as formally denatured alcohol, like TSDA 1 (denatured ethanol B). They would still have to pay duty under current rules.

Time to waive restrictions on distillery ethanol

Alan Powell argues against this. He questions the duty status of ethanol held in duty suspension and ‘converted’ to hand sanitiser, i.e. for external use. If the sanitiser also contains ingredients other than alcohol, including emollients and detergent for example, then it’s not suitable for consumption. Furthermore, he points out that in extreme circumstances, “it can be possible to read into the warehousing provisions the ability to denature ethanol where the duty value exceeds the product”. Additionally, although it is HMRC’s policy for two days’ notice to be given before denaturing the alcohol, “this could be waived provided the records show the amount of spirits denatured/destroyed”.

A bottle of hand sanitiser being filled at Psychopomp Microdistillery

Distilleries already showing the way!

One UK distillery already making its own hand sanitiser is Bristol-based Psychopomp Microdistillery, featured in an exclusive interview for Ryebeck last year. Mixing 65% ethanol with aloe vera gel and their own gin botanicals, they are handing out small bottles of hand sanitiser for free. In return, they do ask for charitable contributions to Bristol children’s hospital charity, The Grand Appeal.

Circumstance Distillery taking the lead

Ryebeck spoke to Dr Liam Hirt, cardiologist and co-owner of Psychopomp and Circumstance Distilleries, about this initiative. “We had the idea at the end of February and the first batch was ready by 4th March. It came about because the team wanted some hand sanitiser and none was available in the shops. We realised that we had all the ingredients we needed to make our own, so decided to do just that. When we had made it, we wanted to give it to the vulnerable people in our lives. It then dawned on us that everyone has vulnerable people in their lives and could not get hand sanitiser. So, we decided to give it away for free to help keep those vulnerable people safe. We have been asking for donations to the local children’s hospital in lieu of payment for those that can afford it.”

Other distilleries inspired by Circumstance

Liam notes that there are other distilleries who want to follow their example. “I have had lots of communication with other distilleries who are planning to follow suit, wanting advice and guidance. If we know there is a problem and have the means to help protect those people but choose not to, there is an element of moral bankruptcy. I do not believe we have reached this yet as a society, well not here in Bristol anyway. However, some distilleries will not have the means to help, despite a willingness.”

Urgent need for duty suspension on distillery ethanol

As a doctor, Liam is acutely aware of the medical need for hand sanitiser. “We have been contacted by nursing homes and GP surgeries asking for hand sanitiser. If vulnerable people are attending a GP surgery for normal care and are coming into contact with potentially infected people, there is a big problem.”

Therefore, Liam is in no doubt of the urgent need for HMRC to suspend duty on distillery alcohol used for hand sanitiser in the fight against Covid-19. “I have been in touch with our local MP asking her to raise the issue. I have also raised the issue with HMRC and through the British Distillers Alliance. Additionally, we have applied for licences from HMRC to buy and to produce denatured alcohol. I am hoping these will be fast tracked.”

Safeguarding against future pandemics

Liam is also mindful of the need to prepare for future potential epidemics and that current licensing requirements and duty costs make the situation more difficult. “We don’t yet have a licence to produce or a licence to buy denatured alcohol. We are using potable duty-paid alcohol, with duty paid at £28.74 per litre. It’s very expensive for us to give this away in our hand sanitiser. At the moment, to remain within HMRCs rules, this is about all we can do. These are strange times. Denaturing is not something we ever thought we would need to do.”

“There would be a threat to excise revenue if anyone who produced alcohol could also destroy it. So I understand why it should be a licensed activity. However, it is worth considering that this is one pandemic in a series of epidemics – SARS, Swine flu, and now Coronavirus. I expect there will be others. Therefore, maybe a change in provisions to allow distillers to denature alcohol during an outbreak is a sensible precaution to enable a swift response in the future.”

Other responses

Brewdog’s Punk Sanitiser

Brewdog has also confirmed that they have started using their distillery to make Punk Sanitiser. The company is similarly giving bottles away to those who need it. “We want to do all we can to help everyone get through this difficult time“, says co-founder James Watt.

Recently, Altia, a Nordic alcoholic beverage business, announced that it would produce enough technical ethanol “round the clock” at its Koskenkorva vodka facility. The company will make up to 200,000 half-litre bottles of hand sanitiser gel each day.

Words of advice

In the face of this latest pandemic, we should all heed Liam Hirt’s advice – “Wash hands when you can, use sanitiser when you can’t.”

… and in the meantime, if we have to isolate ourselves from our usual activities, then at least Liam can offer a few words of comfort. “Please remember that craft distilleries also make delicious spirits that can be ordered online and drunk at home – perfect for long periods of social distancing.” Smaller businesses need all the help they can get to survive and the alcohol industry is a better place for them.

If you’re interested in purchasing distillation equipment or wholesale ethanol than please give Ryebeck a call. You can reach the team on +44 (0) 800 689 3216 or contact them via their online form.

Author: Robin Goldsmith of The Write Taste.

Oktoberfest: known throughout the world

The annual Oktoberfest is the most famous beer festival in the world, attracting more than six million visitors to Munich with over seven million litres of beer. Despite its name, most of it now takes place during the last two weeks of September and only the first week of October. As its popularity has increased, many smaller festivals named in its honour have taken place around the world, but how did this original Bierfest start?

Origins of Oktoberfest

It all began on 12th October 1810 when Crown Prince Ludwig, later to become King Ludwig I, married Princess Therese of Saxony-Hildburghausen. The citizens of Munich were invited to attend the five-day celebration on the fields in front of the city gates, which were named Theresienwiese (“Theresa’s fields”), or ‘Wiesn’ for short, in honour of the Princess. With food, drink, music, dancing, parades and horse-racing, the event was so popular that the decision was made to repeat the festivities in following years. This included an agricultural fair, first held in 1811 and now held every four years, to promote the Bavarian economy. The horse races, however, ended in 1960.

Growth of Oktoberfest

Over time, more amusements and attractions were included as visitors flocked to enjoy the festivities. The number of beer stands also grew and in 1896, they were replaced by tents and halls, supported by some of the local breweries. Today, the largest ones hold up to 10,000 people on two levels, with long wooden tables and benches indoors and outdoors.

Visitors enjoy Oktoberfest attractions

While attracting beer lovers from every continent, most visitors are German with the majority unsurprisingly coming from Bavaria. This year, the new “Chaos Pendel” ride (“Pendulum of Chaos”) with its two cabins on a rotating arm entertained the more adventurous punters, although a full stomach of beer and sausages would not have been advisable!

German Purity Laws

Only six local breweries are allowed to serve beer at the Oktoberfest, all of which follow the Reinheitsgebot, the traditional German purity laws. This cornerstone of Germany’s brewing heritage was introduced in 1516 by Duke Wilhelm IV of Bavaria. The decree allows only hops, barley, water and yeast (after its role in alcoholic fermentation was understood in later years) to be used to brew beer. Initially just relating to Bavaria, since 1906 it has applied to the whole of the country. Additionally, although allowed in the rest of Germany for all beers, in Bavaria malted grains are permitted for top-fermented beers only.

Purpose of the Reinheitsgebot

According to the German Brewers’ Association, the Reinheitsgebot was introduced for three reasons:-

- Protect drinkers from high prices.

- Ban the use of wheat in beer, as it was needed for bread.

- Stop brewers from adding poisonous or otherwise health-endangering ingredients as preservatives or flavourings.

Facing the challenge from the craft beer revolution

Despite the strong traditions of the purity laws, they do not have universal appeal in today’s craft beer world. An increasing number of German brewers have challenged what they see as a straightjacket that hampers creativity by its insistence on only using four ingredients.

Krombacher’s perspective

Nevertheless, the German purity laws remain hugely significant and important to the country’s breweries, as Stephan Kofler, UK Sales & Marketing Director of Krombacher, describes. “The German purity laws are pillars that our brewery and the German beer industry as a whole are built on. They set us apart from other international brewers and ensure we use only the finest ingredients plus time-honoured production methods with the core objective of producing the best beer. Whilst awareness and interest of craft beer has gone through the roof in recent years, Germany’s beer making heritage and reputation for brewing excellence has been built over the last 500 years and has remained undiminished – even with the increased excitement around the small and the new. I actually think the craft boom has helped quality brands like Krombacher as it has meant an increased number of consumers taking an interest in unique, brewed-at-source brands who put taste quality above all else.”

The Oktoberfest celebrations spread to the UK

Even though Krombacher is not involved in the Munich Oktoberfest, the brewery has been incredibly successful in exporting the celebrations to world markets. Stephan Kofler explains: “In the UK, we always have a busy schedule of events in the classic German bars such as Bierschenke, Zeitgeist and Bavarian Beerhouse plus we always look to support and run our own events where possible. We recently ran an Oktoberfest BBQ at the Express Tavern in Kew showcasing our full range and we even made some Beerwurst for the occasion!”

The global beer landscape has changed radically since the last century. A plethora of ingredients, flavours and brewing techniques abound with more choices available than ever before. With traditional top and bottom-fermented beers still being brewed around the world, the Reinheitsgebot continues to be relevant, not just to German drinkers, but to fans of good beer wherever they are. Prost!

If you’re a brewery looking to produce top quality beer that fully complies with the Reinheitsgebot, Ryebeck is able to supply you with expertly chosen, state-of-the-art German equipment. We welcome enquiries via the Contact Page on our website, or alternatively please call us on +44 (0) 800 689 3216 or email our sales team at [email protected].

HIGH PERFORMANCE WATER BATH DISTILLERY UNIT FOR ALCOHOLIC BEVERAGES 2 X 500L

SOLD

- Make: Arnold Holstein

- Year: 1983

- Capacity: 500l X 2

- Max Operating Pressure: 1 bar

- Length: 3900 mm

- Width: 2120 mm

- Height:4000 mm

- Weight: 2.5 tonnes

- Hemispherical tank diameter: 1150 mm

- Water jacket: stainless steel with insulation

- Filling opening: 400 mm

- Outlet: DN 125 with ball valve 3”, optional 4”

- Copper column: 450 mm with copper bottoms

- Sight glasses DN 100

- Tube cooler

- Copper catalyst

- With built in agitator

HOW IT WORKS:

- Water Bath distillery is heated with steam. Batch capacity: 2 x 500 ltr. Filling is done through the manhole on the front, diameter 350 mm. Bubble on the top in copper.

- By heating the mash, the alcohol rises through the up basin in stainless steel. Then it goes to the fine distillation unit.

- Through the pre cooler/dephlegmator with temperature indicator flows the alcohol to the stand pipe.

- Then the alcohol flows to the tubular cooler coming out as first, second and/or final alcohol.

- Central outlet discharge diameter 80 mm in stainless steel, with quick opening valve.

- Steam consumption approx. 300 kg max. by 13 bar – max.alc. 80%

TECHNICAL DATA FOR THE PUMP:

- Make: ALLWEILER SEEBERG

- Type: SEP3801

- Year: 1980

- Q (l/min): 116/310

- N (l/min): 230/460

The information provided is for guidance only and the buyer should check all details upon inspecting the line

SPIRIT BOTTLING LINE FOR ALCOHOLIC BEVERAGES – 700-150 BPH

Speed 700-1500 bph for 70 cl bottle

Filler Capper MBF type Synchrofill 720.12TG/1M/1V – Year 2010

4 formats of caps: ROPP (screw) aluminium cap, T cap plastic head and cork body, GPI (plastic screw), mushroom cork (already formed)

4 formats of bottles : Néos, Kendo, 1 model champagne bottle and 1 special bottle

Spirit Bottling Line for Alcoholic Beverages – 700-1500 BPH

There are cap sorters for all types of caps included

Capsuling machine Robino & Galandrino for shrinkable cap. 1 shrinking head

Labeller 2 cold glue labelling station Kosme – Year 1993

About 15 m conveyors

Line stopped in 2016 in very good condition

Filling monobloc is in new condition, was in production for only a short time

Capsuling and labelling machines – Year 1993 – in perfectly maintained condition

Spare parts available for each machine

Price: On request Euros, GBP or USD ex works as is excluding dismantling, packing and loading.

The information provided is for guidance only and the buyer should check all details upon inspecting the line

SPIRIT BOTTLING LINE FOR ALCOHOLIC BEVERAGES – 700-1500 BPH

Speed 700-1500 bph for 70 cl bottle

Filler Capper MBF type Synchrofill 720.12TG/1M/1V – Year 2010

4 formats of caps: ROPP (screw) aluminium cap, T cap plastic head and cork body, GPI (plastic screw), mushroom cork (already formed)

4 formats of bottles : Néos, Kendo, 1 model champagne bottle and 1 special bottle

There are cap sorters for all types of caps included

Capsuling machine Robino & Galandrino for shrinkable cap. 1 shrinking head

Labeller 2 cold glue labelling station Kosme – Year 1993

About 15 m conveyors

Line stopped in 2016 in very good condition

Filling monobloc is in new condition, was in production for only a short time

Capsuling and labelling machines – Year 1993 – in perfectly maintained condition

Spare parts available for each machine